Maximum borrowing capacity

How your existing credit card and overdraft limit can impact your borrowing power. Compare Get Personal Loans Here.

Borrowing Capacity Explained Your Mortgage

Some factors that affect a borrowers capacity are external and therefore have little to do with the specific characteristics of the company.

. You can borrow up to 642200. Our target is less than - 5 variance from lender calculators for all lenders. Total advance exposure cannot exceed 30 of the members total assets unless an exception is requested by the.

Dont Wait Get Started Now. Maximum borrowing is designed to closely match lenders actual borrowing capacity. Ad No Credit Checks Needed.

We would like to show you a description here but the site wont allow us. About 380000 less After going through the above three tables we hope that you have a better understanding about. Lenders will consider any credit cards to be drawn to their full limit even if you have never exceeded the.

Standard borrowing capacity is. A Any credit union which makes application for insurance of its accounts pursuant to title II of the Act or any insured credit union must not. You dont have to loan the full amount you are pre approved for.

You can borrow up to 830000. You can get an estimate for this amount through a mortgage pre-qualification or for more certainty a. If interest rates rise or unexpected expenses pop up and youre borrowing at your maximum capacity you may not be able to meet your repayments.

Need a Personal Loan but Have Bad Credit. Fast Easy Form. Ad Fill in One Simple Form Get The Best Personal Loan Offers for You.

Of Directors can affect your maximum borrowing capacity such as. Get an estimate in 2 minutes. Start date May 5 2009.

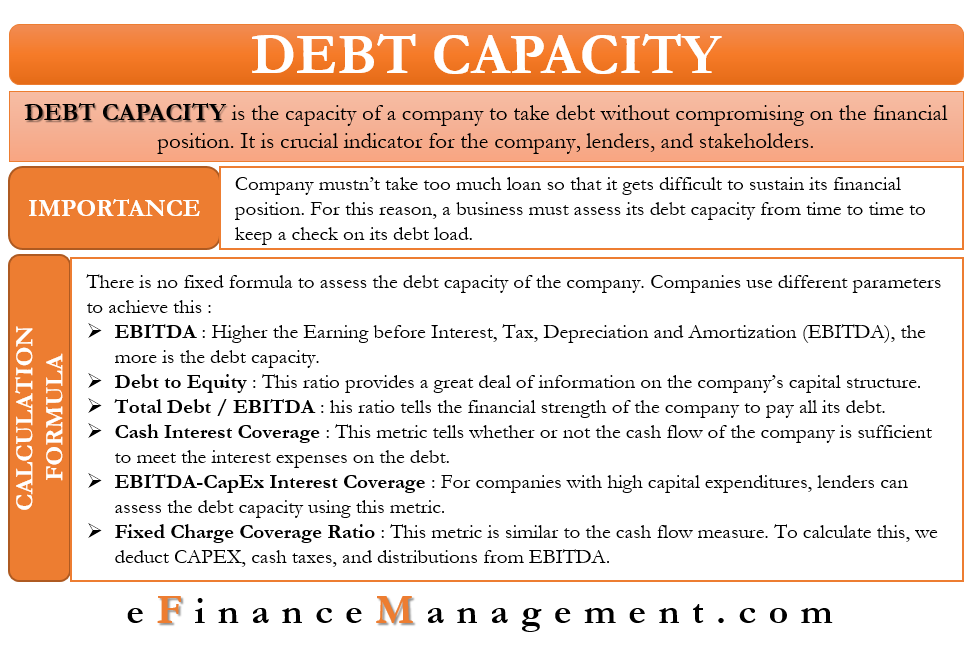

The external factors include. 7412 Maximum borrowing authority. Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency.

With respect to clauses a of the definitions of Borrowing Capacity in Sections 11 of the Agreements the maximum aggregate Borrowing Capacity of Borrowers shall be. In fact less than a quarter of borrowers are utilising their maximum borrowing capacity. Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI.

View your borrowing capacity and estimated home loan repayments. This chart from 2018 shows the distribution of borrowing capacity used over past. Estimate how much you can borrow for your home loan using our borrowing power calculator.

Get Low-Interest Personal Loans Up to 50000. Typically if you dont have a deposit. 21 rows Bank 1.

Maximum borrowing capacity formula. Calculate how much you can borrow to buy a new home. For a conventional loan your DTI ration cannot exceed 36.

You can borrow up to 857000. The first step in buying a property is knowing the price range within your means. You can borrow up to 716000.

May 5 2009 1 Hi I am. Switch Finance - Maximum Borrowing. Joined May 5 2009 Messages 6.

Consider borrowing under what is deemed as your maximum threshold to make. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

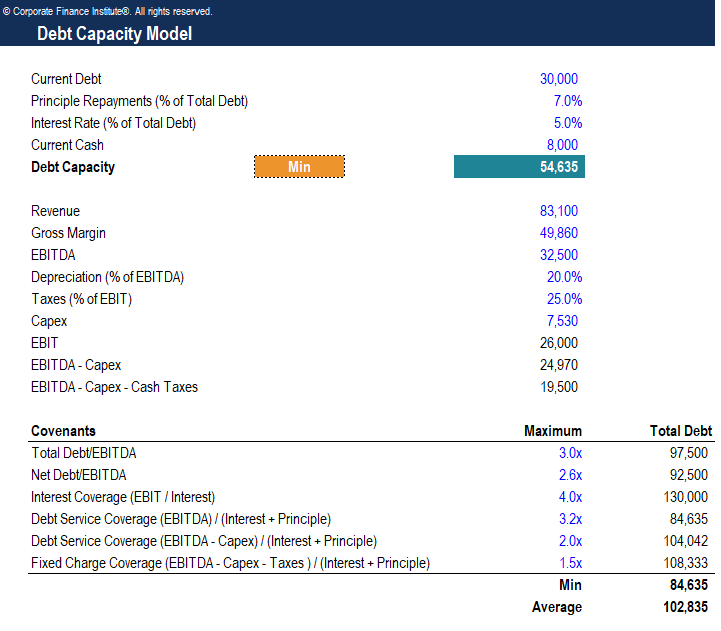

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

Debt Capacity Lender Model Analysis Considerations

Excel Formula Calculate Original Loan Amount Exceljet

How Much Can I Borrow Home Loan Calculator

Debt Capacity Model Template Download Free Excel Template

Asset Based Lending Corporate Finance Commercial Banking Citizens

What Can Affect Your Borrowing Power

160k Less Rising Interest Rates Are Shrinking Your Borrowing Capacity

Va Loan Calculator

Box B The Impact Of Lending Standards On Loan Sizes Financial Stability Review October 2018 Rba

How Much Can I Borrow Home Loan Calculator

Debt Capacity Meaning How To Assess And More

Changes To Assessment Rates How Do They Impact Your Borrowing Capacity Sf Capital

What Can Affect Your Borrowing Power

What Is Asset Based Lending Who Qualifies

How Increasing Your Income Is The Biggest Driver To Increasing Your Borrowing Power Confidence Finance Mortgage Brokers

Apra S Mortgage Crackdown Catches Out Hopeful Home Buyers Abc News